Is the future development potential of titanium and titanium alloy high-end products greater?

- Share

- Issue Time

- Apr 28,2020

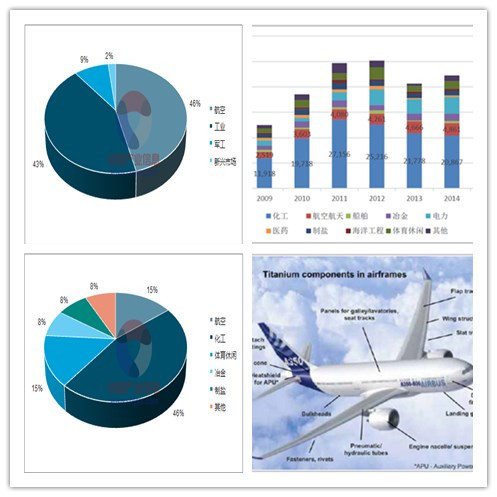

There are more than 160 titanium alloy manufacturers in China. There are few enterprises with good independent research and development ability, high product technical content and excellent brand characteristics. Most of them are concentrated in the middle and low-end fields, especially the low-end market with excess capacity and fierce competition.China's petrochemical, aerospace, electric power, Marine engineering and other industries continue to have strong demand for high-end titanium alloy products, and the market demand for titanium alloy is shifting from the low-end to high-end fields.However, the number of high-end titanium alloy production enterprises is small and the market supply is insufficient.

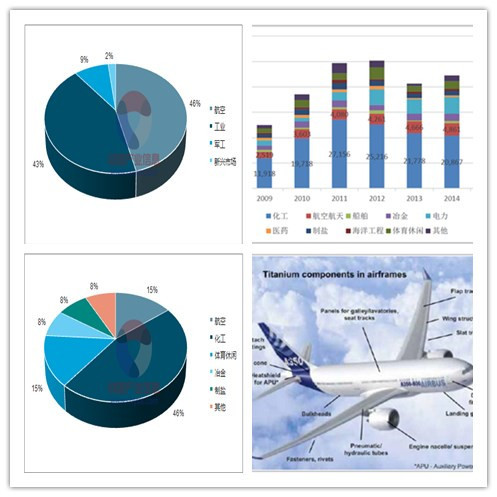

At present, only 10% of China's titanium alloy products are applied in the high-end field, while 50% of the titanium alloy products in the United States are applied in the high-end field.With the development of large aircraft and continuous upgrading of military aircraft, the demand for titanium alloy in aviation industry will continue to increase.From the perspective of the import unit price of China's titanium alloy products in 2018, the import unit price is much higher than the export unit price, indicating that China's high-end titanium alloy products are in short supply and the market relies on imports.The industry needs to continuously improve the ability of r&d and innovation, improve product performance, develop new functional products and accelerate the pace of import substitution in the high-end titanium alloy market.

In 2017, China's titanium production was about 33 million tons, and in 2018 the industry's output declined.Under the influence of weak market demand, high port inventory and unoptimistic economic situation, the operating rate of large enterprises in China's titanium alloy industry was better in 2018, while small enterprises were cautious in resuming production, and the overall output of the industry declined.With the increase of market demand for high-end titanium alloys in China, large enterprises with higher technical level have greater development potential in the future.

According to industry analysts said the growing importance of the national policy for high-tech industry, aerospace, shipbuilding, Marine engineering, domestic transportation, military areas such as the growing demand for high-end materials, high-end titanium alloy production strategy is of great significance, titanium industry to adjust product structure, the shift to high-end fields become inevitable trend.Therefore, the titanium alloy industry will have increasingly high technical requirements for production enterprises. Only by constantly improving the core competitiveness of enterprises can they achieve further development. In the future, the technical barriers to enter the titanium alloy industry will continue to increase.

According to the 2019-2023 titanium alloy industry market in-depth research and investment forecast analysis report, the global titanium alloy production capacity is mainly concentrated in China, the United States, Russia, Japan and other countries, in 2010, China surpassed the United States to become the world's largest producer of titanium alloy.American titanium alloy products are mainly high-end products, mainly used in the field of aviation, while Chinese titanium alloy products are mainly concentrated in the low-end field, with low technical content, mainly used in the field of industry.Compared with the United States, China's titanium alloy industry is large but not strong, the overall competitiveness is weak.